Breadcrumb Trail Links

News Executive Summary Executive

Expert says people’s top choice for advice may not actually be doing them any favours

Article content

Many Canadians are seeking financial guidance as high inflation, rising interest rates and an increased cost of living take a toll on their finances, and family and friends are often their go-to source for advice, according to a new survey by personal finance site WealthRocket.

Advertisement 2

Article content

Article content

Almost half of the 1,200 Canadian adults surveyed have sought financial advice in the past 12 months. Half of them turned to family and friends, while 49 per cent went to their bank and 39 per cent visited social media sites.

Although going to your loved ones may be a natural starting point, it’s not the best place to look for financial advice, said David O’Leary, a chartered financial analyst and WealthRocket’s personal finance expert.

“Unless your friends or family have a background in financial planning, it’s probably not a great place to be going for financial advice,” he said in a press release. “There are a lot of misunderstandings about how things actually work.”

O’Leary also said you might be receiving biased information when consulting with a bank.

Article content

Advertisement 3

Article content

“The adviser at a bank is more often a salesperson upselling and cross-selling different types of products,” he said. “There’s a lot of pressure internally to sell the bank’s products and services as they’re giving advice.”

The resulting less personalized experience could be why only half of Canadians who received advice from their bank found it helpful, according to a recent J.D. Power study.

The next place Canadians turn to for guidance is social media, even though 26 per cent find it to be an untrustworthy source for financial advice. Some could be surfing the web because it’s less committal or intimidating to seek guidance privately or anonymously rather than getting face-to-face advice.

Strategic life and business coach Leisse Wilcox has witnessed this firsthand on her Instagram account.

Advertisement 4

Article content

“Money is still one of the great taboo subjects,” she said in the press release. “So while I find people less open to commenting, my DMs have seen an uptick in conversations.”

Wilcox, who focuses on helping women make better financial decisions, said she has noticed an increase in followers and engagement over the past year.

Although there can be good advice on social media, people need to be highly critical of what they’re viewing, O’Leary said.

“I don’t know that a lot of non-experts are well-positioned to try and suss that out,” he said. “That’s the challenge.”

Canadians’ top reasons for seeking advice was the increased cost of living/inflation (37 per cent), help with investing (29 per cent), rising interest rates (26 per cent) and getting out of debt (21 per cent). But 19 per also feel like their finances are out of control.

Advertisement 5

Article content

“Financial pressure and anxiety can lead you to make poor choices, like sticking your head in the sand or avoiding looking at your statements,” O’Leary said. “If that’s happening to you, recognizing it is an important first step to dealing with it.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox._____________________________________________________________

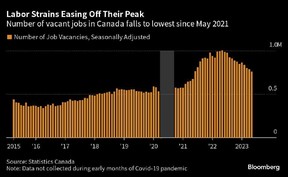

The number of job vacancies in Canada continues to decline, suggesting demand for labour is cooling amid higher interest rates and strong population gains. The number of unfilled positions fell 26,000 to 759,000 in May, the lowest in two years. That’s down nearly a quarter from a peak of one million in the same month last year, Statistics Canada reported July 27 in Ottawa. — Bloomberg

Advertisement 6

Article content

___________________________________________________

___________________________________________________

_______________________________________________________

Advertisement 7

Article content

____________________________________________________

More than 1,000 cases related to past COVID-19 benefits are now winding their way through Federal Court as taxpayers wage battle with the Canada Revenue Agency. We often hear of those who lose their battles, but tax expert Jamie Golombek has the details on one taxpayer who won.

Latest Bank of Canada rate hike to take toll on people’s finances

Bank of Canada interest rate hikes not the only way to tame inflation

Canada’s standard of living is falling behind rest of developed world

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation