Breadcrumb Trail Links

News

Just a little more than half of people across Canada say they’ll leave money to the next generation, Canadian Western Bank says

Article content

Canadians are expected to pass on as much as $1 trillion in inheritances over the next decade, though you may have a better chance of being on the receiving end depending on which province you live in, new research suggests.

Article content

Just a little more than half of people across Canada say they have the financial means to leave an inheritance to family or friends, according to a recent survey from Canadian Western Bank and conducted by Angus Reid. But for residents of Quebec, that number rises to 60 per cent. In Ontario, 52 per cent of people say an inheritance is in the cards for their loved ones.

Advertisement 2

Article content

People in the Atlantic provinces are least likely to leave an inheritance, with only 42 per cent saying they’re planning to pass money or assets on, Canadian Western Bank said. Rounding out the bottom of the list are Manitoba, where 49 per cent say they’re planning to leave money to the next generation, followed by 47 per cent in both Saskatchewan and British Columbia.

Location isn’t the only factor playing a role in inheritance intentions. Canadian Western Bank’s research shows age is a predictor, too, and 72 per cent of those aged 55 or older expect to pass on money or assets. In comparison, only 44 per cent of people aged between 35 and 54 can say the same. Meanwhile, a third of those below the age of 35 think they won’t have anything to pass on at all.

The bank said those findings suggest Canadians — especially younger generations — are dragging their feet on estate planning, which could cause problems for their heirs down the line. Those who don’t undertake some sort of financial management may end up leaving their heirs with a burden, it cautioned in the report. And without a proper will, they also risk giving up control of who benefits from their legacy.

Article content

Advertisement 3

Article content

“While it is common for younger Canadians to put off their estate or inheritance plans, especially given many young families carry debt from mortgages, lines of credit, car loans, or even credit card debt, putting a plan in place as early as possible ensures Canadians are taking control of where their estate will be directed if they were to pass away,” the report said.

Failing to plan ahead could also lower the likelihood of leaving a living inheritance, in which people pass on cash or assets to the next generation while they’re still alive. The trend, which has been gaining in popularity, might take the form of cash gifts in lump, monthly or yearly sums, the gifting of a home, or paying for a family vacation. Not only does such a scheme allow someone to enjoy the fruits of their labour with loved ones, but it could also be a financially savvy move, with potential tax savings to be had. Still, planning ahead is key for anyone who wants to take advantage, the bank said.

Of course, looking beyond location and age, household income also plays a significant role in inheritance planning and intentions. The survey found that the more money children have, the more likely they are to initiate discussions with their parents about an inheritance. For example, 63 per cent of people who make more than $100,000 a year say they’ve had inheritance conversations with their parents. The number falls to 45 per cent for those making $50,000 or less.

Advertisement 4

Article content

Sign up here to get Posthaste delivered straight to your inbox.

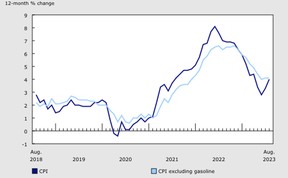

Canadian inflation stayed high in August, accelerating to a four per cent increase year over year, up from 3.3 per cent in July.

The consumer price index reading from Statistics Canada marks the second month in a row that price pressures have accelerated, pushing inflation well out of the Bank of Canada’s target range of one to three per cent, even after the most aggressive interest rate hiking cycle in its history.

Both core and trim CPI — the measures the Bank of Canada favours when considering inflation since they strip out the more volatile items — also accelerated in August.

Inflation gains were driven by higher year-over-year gasoline prices, up 0.8 per cent. Shelter costs accelerated six per cent and the mortgage cost index was up 30.9 per cent in the month.

Advertisement 5

Article content

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Canadian inheritances could hit $1 trillion over the next decade

What happens if someone does not follow the terms of a will?

Getting married can be an expensive proposition if you get carried away and that could mean starting off your life together facing a mountain of debt. Fortunately, debt counsellor Sandra Fry has some tips so you don’t turn blue after your big day.

Today’s Posthaste was written by Victoria Wells, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation