Breadcrumb Path Hyperlinks

Information

Report-breaking manufacturing predicted for the remainder of this decade

Article content material

Article content material

Good Morning!

Commercial 2

Article content material

They name it the “period of optimization.”

And it’s why, for the primary time in 5 years, Wall Road analytics agency S&P World Commodity Insights is elevating its outlook for Canada’s oilsands.

Oilsands manufacturing is now anticipated to achieve 3.7 million barrels per day by 2030, half one million bpd greater than in the present day and 140,000 greater than final 12 months’s forecast.

Final 12 months it didn’t appear like both power safety fears or larger crude costs had been having a lot impact on oilsands manufacturing, wrote Celina Hwang, director of North American crude oil markets, and Kevin Birn, Canadian oil markets chief analyst, who authored the report.

“A 12 months later, one may conclude that the response to larger costs simply took longer than anticipated to have their typical impact,” they mentioned.

Commercial 3

Article content material

Capital expenditures in 2022 reached their highest degree since 2015 among the many 4 largest oilsands producers and will go larger in 2023, they mentioned. Nevertheless, a lot of this went to maintaining with inflation and to not constructing new initiatives.

What will probably be driving oilsands development this time round isn’t new mega-projects however somewhat enhancing effectivity and optimizing output, they mentioned.

“The Canadian oilsands have entered an ‘period of optimization’,” mentioned Birn. “Studying by doing and step-out optimizations account for practically 90 per cent of our total manufacturing outlook.”

The remaining 10 per cent comes from eradicating bottlenecks that restrict manufacturing stream.

Birn mentioned the final time oil costs had been this excessive the oilsands noticed a surge in growth. This time by optimizing its already massive base of belongings producers can materially enhance output whereas sustaining the capital self-discipline buyers need.

Article content material

Commercial 4

Article content material

“Larger oil costs have pushed report returns for the Canadian oilsands,” mentioned Hwang. “Though producers proceed to display capital self-discipline, stronger stability sheets are actually giving oilsands corporations renewed confidence in regard to their intentions for capital spending.”

S&P World expects Canada to proceed to publish report oil manufacturing for the remainder of the last decade. Output development will begin to gradual within the mid to late 2020s, and a “very shallow decline” will solely start to emerge within the early 2030s. Will probably be notably shallow due to the lengthy, flat manufacturing typical of the oilsands, the analysts mentioned.

Oil costs have retreated these days over considerations about demand within the slowing world financial system. However the Worldwide Power Company says market pessimism is in stark distinction to its forecast of a tighter market within the second half of this 12 months, the place it expects demand to exceed provide by nearly 2 million bpd.

Commercial 5

Article content material

The Canadian Affiliation of Petroleum Producers (CAPP) predicts funding in oil and fuel manufacturing in Canada will leap by 11 per cent this 12 months to hit $40 billion. Oilsands funding is seen reaching $11.5 billion.

As effectively, the completion this 12 months of the Trans Mountain pipeline enlargement is predicted to supply producers an additional 590,000 barrels per day of export capability.

The one fly within the ointment to S&P’s outlook could possibly be a federal cap on oilsands emissions.

“If the emissions targets show too stringent, and unattainable by the trade, then additional funding — nonetheless modest — could possibly be in danger,” Hwang and Birn wrote.

_____________________________________________________________

Was this article forwarded to you? Enroll right here to get it delivered to your inbox._____________________________________________________________________

Commercial 6

Article content material

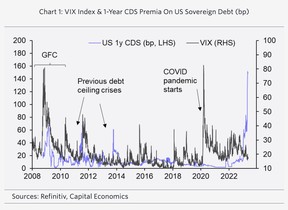

The U.S. debt ceiling saga continues, casting one’s thoughts again to different instances lawmakers skated this near default.

Congress has raised, prolonged or revised the debt restrict 78 instances since 1960, 49 instances below Republican presidents and 29 below Democratic presidents.

In every of those instances, lawmakers handed a deal that averted default.

However again in 2011, they got here fairly shut. Similar to in the present day if was a cliff hanger that roiled markets simply on the prospect of a default.

Congress lastly resolved the disaster by passing the Funds Management Act however that wasn’t the top of it. After passage of the act, Normal & Poor’s downgraded america’ long-term credit standing for the primary time ever from AAA to AA+, saying the fiscal plan fell quick.

Commercial 7

Article content material

The newest on this 12 months’s saga. U.S. President Joe Biden and prime congressional Republican Kevin McCarthy appeared near a deal in the present day, stories say, however the June 1 deadline is rapidly approaching. Tick tock.

___________________________________________________

_______________________________________________________

Commercial 8

Article content material

It’s estimated that round 6.2 million Canadians over the age of 15 have a number of disabilities associated to ache, flexibility, mobility or psychological well being. But a lot of them aren’t profiting from the registered incapacity financial savings plan (RDSP). Susan O’Brien has the nuts and bolts of this great tool designed to help mother and father and people dwelling with disabilities to avoid wasting for long-term monetary safety. Discover out extra

Here is the place fuel costs could be headed this summer time

The place’s the increase? How Alberta missed the oil bonanza this time spherical

Albertans hit hardest by inflation as ‘Alberta benefit’ melts away

____________________________________________________

Right now’s Posthaste was written by Pamela Heaven, @pamheaven, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E mail us at posthaste@postmedia.com, or hit reply to ship us a observe.

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled e mail notifications—you’ll now obtain an e mail for those who obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Group Pointers for extra data and particulars on find out how to alter your e mail settings.

Be a part of the Dialog