The connection between the US and China is prone to decide humanity’s destiny within the twenty first century. It is going to decide whether or not there can be peace, prosperity and safety of the planetary atmosphere, or the opposites. Ought to it’s the latter, future historians (if any such truly exist) will certainly marvel on the incapacity of the human species to guard itself towards its personal stupidity. But at this time, fortunately, we are able to nonetheless act to forestall catastrophe. That’s true in lots of domains. Amongst these is economics. How then are financial relations to be finest managed within the more and more tough future we confront?

Janet Yellen, US Treasury secretary, and Ursula von der Leyen, president of the European Fee, have each not too long ago made considerate statements on this subject. However do they set out a workable future? On that I’m, alas, uncertain.

Yellen units out a plan for what she calls “constructive engagement”. This has three components: first, “safe our nationwide safety pursuits and people of our allies and companions, and . . . shield human rights”; second, “search a wholesome financial relationship” based mostly on “honest” competitors; and, third, “search co-operation on the pressing international challenges of our day”. In her dialogue of the primary aspect, she makes the purpose that US “nationwide safety actions are usually not designed for us to achieve a aggressive financial benefit, or stifle China’s financial and technological modernisation”. But the problem is that this isn’t in any respect the way it appears in China, as I learnt throughout a quick latest keep in Beijing.

Yellen’s dialogue of the essential safety aspect brings out how problematic it needs to be. She stresses, for instance, US concern about China’s “no limits” partnership and help for Russia, and warns it towards offering materials help or assist in evading sanctions. She stresses, too, US considerations over human rights, together with these the Chinese language regard as purely inside issues.

However such considerations, she states that “we don’t search to ‘decouple’ our financial system from China’s”. Quite the opposite, a “rising China that performs by the foundations could be helpful for the US”. In spite of everything, she reminds us, the US trades extra with China than with every other nation, besides Canada and Mexico. Nonetheless, she provides, the US objects to China’s many “unfair” commerce practices and can proceed to “take co-ordinated actions with our allies and companions in response”. Motion on provide chains, together with “friendshoring” is one end result.

Von der Leyen’s strategy is complementary. She, too, states that “decoupling is clearly not viable, fascinating and even sensible for Europe”. But China, she argues, “has now turned the web page on the period of ‘reform and opening’ and is shifting into a brand new period of ‘safety and management’”. Her focus, very like that of the US, is on “de-risking” the connection. A technique is by eradicating vulnerabilities and preserving strategic autonomy. As within the US, this entails strategic investments in sure key sectors. One other means is by lively use of commerce defence devices. Yet one more is by inventing new devices to make sure that European firms’ capital and information “are usually not used to boost the army and intelligence capabilities of those that are additionally our systemic rivals”. This might embody controls on outbound funding. A ultimate means is deeper co-operation with companions.

In a latest, notably pessimistic e-book, The Avoidable Struggle, Kevin Rudd, former prime minister of Australia, argues for what he calls “managed strategic competitors” between the US and Xi Jinping’s China. Yellen and von der Leyen are, one would possibly argue, fleshing out the financial components of this strategy.

In that case, it’s unlikely to work. Unilateral efforts on one facet to really feel safer are certain to make the opposite facet extra insecure. That is evidently true within the safety space, narrowly outlined. If one facet has a lead in a basic expertise, the opposite can be susceptible. However additionally it is true in economics. Refusal to promote strategically very important applied sciences or sources — and even the opportunity of that occuring at some second in future — will make the opposite facet really feel economically insecure. Certainly, it grew to become clear in Beijing that knowledgeable Chinese language consider that the US does certainly goal to thwart its financial rise. US controls on chip exports could also be designed to strengthen US safety. However they’re additionally a curb on China’s financial system. The 2 can’t be separated.

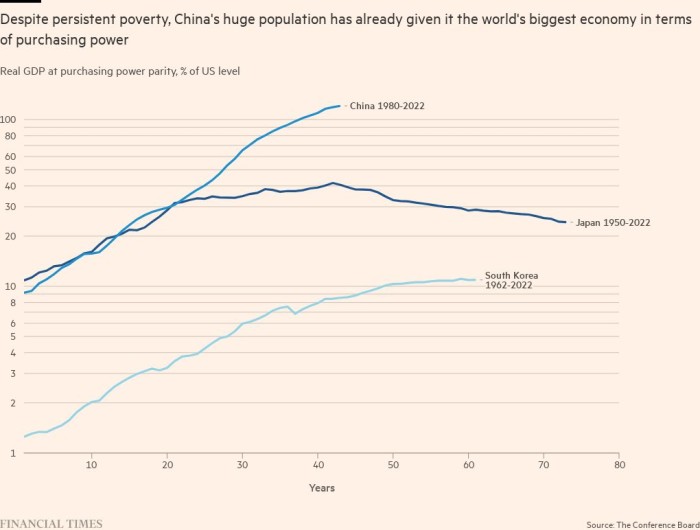

Neither is this battle prone to get simpler. Measured in comparable phrases (at “buying energy parity”), the economies of the US and its allies stay some 80 per cent larger than these of China and Russia collectively. But China remains to be a poor nation: at PPP, China’s GDP per head in 2022 was nonetheless lower than 30 per cent that of the US. Suppose it managed to succeed in the present relative place of South Korea. Its financial system would then be nearly half as massive once more as these of the US and EU, mixed. Will this occur? Most likely not. However, given previous efficiency, it can’t be dominated out. In any case, China already has a potent financial system, an enormous function in world commerce and an enormous army. (See charts.)

The period of strategic confrontation we have now entered is horrifying. That is particularly so for these of us who need the beliefs of particular person freedom and democracy to thrive, whereas co-operating with China in each sustaining peace and prosperity and defending our treasured planet. Someway, we have now to co-operate and compete, whereas additionally avoiding army battle. Our place to begin have to be to realize the best potential transparency over our goals and plans. We learnt the need of that after the Cuban missile disaster in 1962. However we’ll want way over that and doubtless for longer. Few leaders in historical past have borne a heavier ethical burden than these of at this time.

martin.wolf@ft.com

Comply with Martin Wolf with myFT and on Twitter