Breadcrumb Path Hyperlinks

Information Govt Abstract Govt

56% harbouring fears banks may fail in a disaster, survey says

Article content material

Within the wake of three regional financial institution failures in america, some Canadians are eyeing their very own banking system with trepidation, with just a few even withdrawing their money simply to be protected.

Commercial 2

Article content material

Article content material

Greater than half of Canadians, or 56 per cent, say they’re fearful the nation’s banks may fail within the face of a monetary disaster, based on a current survey carried out by WealthRocket, a private finance website. Youthful generations are most fearful concerning the prospects of a collapse, and 64 per cent of these between the ages of 35 and 44 say they’re involved, together with 63 per cent of these aged 25 to 34.

Such issues are translating into worry over the protection of their deposits, and 28 per cent say they’re at the very least considerably fearful their cash is at risk. One other 29 per cent fall into the “very” or “extraordinarily fearful” class. Solely 19 per cent haven’t any qualms in any respect.

These worries have led 58 per cent to take steps to protect their cash in case of bother, and 22 per cent have gone as far as to have pulled cash from a Canadian financial institution previously 30 days. Others have taken much less drastic steps to maneuver money, akin to transferring to an funding account or one other monetary establishment, or purchased various property, akin to cryptocurrency and valuable metals akin to gold.

Commercial 3

Article content material

The survey outcomes supply a glimpse into the temper of Canadians as turmoil rocks the U.S. banking sector. “There’s a whole lot of worry and panic going round,” David-Alexandre Brassard, chief economist at Chartered Skilled Accountants Canada, mentioned in WealthRocket’s report.

In March, Silicon Valley Financial institution grew to become the most important U.S. financial institution to break down for the reason that peak of the 2008 monetary disaster, and the second-biggest failure in U.S. historical past. Days later, Signature Financial institution adopted swimsuit. Subsequent got here the compelled sale of First Republic Financial institution to JP Morgan & Chase Co. in April. Within the midst of the failures, shares of regional banks have been risky as regulators scramble to stem panic over the banking system. Trade watchers say extra turmoil and additional failures could lie forward.

Article content material

Commercial 4

Article content material

However specialists say a significant financial institution collapse in Canada isn’t a probable situation. Canada has solely 34 banks, together with the Large Six main establishments, in comparison with 7,000 in america, and all should comply with strict laws. Additional, Canada’s banks are well-diversified and worthwhile, giving them ample cushion within the occasion of even a touch of bother. “Canadian banks are a few of the most worthwhile in the whole world,” Brassard mentioned within the report. “They’re not in an uncomfortable monetary state of affairs.”

They’ve additionally weathered earlier upheaval in a single piece, solely to emerge stronger. Financial institution of Canada deputy governor Toni Gravelle mentioned in late March that the Canadian banking system is much more resilient now than through the 2008 monetary disaster. He additionally mentioned the central financial institution is “able to act” to shore up the monetary system in case of contagion from the present upheaval.

Commercial 5

Article content material

Financial institution failures in Canada are comparatively uncommon, with the final occurring in 1996, when Calgary-based Safety House Mortgage Corp. closed, affecting $42 million belonging to 2,600 depositors, based on the Canada Deposit Insurance coverage Corp. (CDIC). In the meantime, america has had 564 banks fail since 2001, information from the Federal Deposit Insurance coverage Corp. exhibits.

Canadians may additionally sleep higher realizing their financial institution deposits are protected by CDIC, a Crown company. If a financial institution fails, CDIC ensures deposits of as much as $100,000, per account class. There’s an opportunity that restrict may be boosted, too. Ottawa mentioned within the 2023 federal finances that it’s exploring growing the utmost quantity CDIC insures. CDIC protection on financial institution deposits is computerized, which means you don’t have to use for it, and is designed to provide individuals entry to their cash in a well timed method in case of a failure. For instance, in 1996, the Crown company made payouts to all Safety House Mortgage prospects inside three weeks.

Commercial 6

Article content material

If that isn’t assurance sufficient, individuals can even relaxation simple realizing that regulators are watching the banking system very carefully, and can act shortly if wanted, Brassard mentioned. “Recognizing a nasty apple whenever you’ve received six banks shouldn’t be onerous,” he mentioned. “If certainly one of them goes astray, you’ll see it fairly quick.”

_____________________________________________________________

Was this text forwarded to you? Join right here to get it delivered to your inbox._____________________________________________________________

Canadian job numbers for April aren’t as bullish as they appear, and are extra of a mirage than a miracle, writes economist David Rosenberg of Rosenberg Analysis & Associates Inc.

First, he says that many of the positive aspects have been in part-time jobs. Full-time jobs fell by 6,200 positions final month, and accounted for under 45 per cent of complete employment development in February by means of April. Plus, these jobs are principally in “low value-add providers,” he mentioned.

Commercial 7

Article content material

What’s extra, development in prime working-age workers, aged 25 to 54, has slowed, accounting for lower than 20 per cent of general employment development over the previous three months. That’s vital as a result of that age group drives client spending.

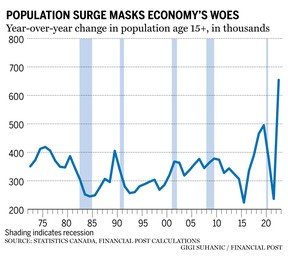

So as to add to that, a surge in inhabitants development, proven within the chart above, can be masking financial cracks. “What seems to be a jobs growth shouldn’t be one in any respect,” Rosenberg mentioned. “Why? As a result of previously three months, the tempo of job creation has lagged effectively behind Canada’s rampant immigrant-fuelled inhabitants bulge.”

Learn Rosenberg’s full take.

___________________________________________________

Commercial 8

Article content material

___________________________________________________

_______________________________________________________

Why Canada and India may lastly signal a commerce settlement

Why are automobiles so costly in Canada right now?

____________________________________________________

Residing prices are excessive proper now, however utilizing credit score to get by can harm in additional methods than one, each now and sooner or later. Credit score counsellor Sandra Fry gives some methods to maintain your credit score rating wholesome, but in addition reminds us that it’s extra vital to maintain your self wholesome. You may all the time repair your rating later.

____________________________________________________

As we speak’s Posthaste was written by Victoria Wells (@vwells80), with extra reporting from Monetary Publish employees, The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at posthaste@postmedia.com.

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail in case you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Pointers for extra data and particulars on easy methods to alter your e mail settings.

Be a part of the Dialog