Breadcrumb Trail Links

News Executive Summary Executive

59% expecting a negative impact, survey says

Article content

The Bank of Canada‘s latest interest rate hike — the 10th increase to its key overnight rate since 2022 — is adding even more pressure on Canadians already struggling to keep up with the cost of living.

Advertisement 2

Article content

Article content

Three-in-five (59 per cent) are expecting the rate increase to have a negative impact on their finances and one-third (34 per cent) are bracing for “significant” challenges, according to a new survey by the Angus Reid Institute, which polled 1,600 Canadian adults.

Those paying a mortgage are experiencing the direct impact of increasing interest rates, with nearly two-in-five (37 per cent) having trouble making their payments. Nine in 10 mortgage-holders (89 per cent) are anticipating the latest increase will further exacerbate this pain.

Among the half (51 per cent) who find their current mortgage payments “manageable,” a majority (60 per cent) fear the rate hike will hinder their ability to keep payments in this comfortable zone going forward.

Advertisement 3

Article content

It’s not just homeowners who are finding it difficult to keep up with their payments. An even larger number of renters (45 per cent) are struggling to pay their monthly rent, with two-thirds (63 per cent) expecting their finances to worsen from the rate increase.

Unlike homeowners, renters are faced with the indirect impact of the central bank’s policy decisions as landlords pass on their increased mortgage costs to tenants. Competition for rentals is also increased as prospective homebuyers delay purchases and wait for interest rates to settle.

As a result, enthusiasm for rate hikes is diminishing, with the percentage of Canadians who want rates to fall nearly tripling since May 2022.

But Canadians are still divided on how the Bank of Canada should proceed with interest rates for the rest of the year.

Article content

Advertisement 4

Article content

The largest group (36 per cent) wants governor Tiff Macklem to lower rates, up 13 points since September 2022, when the policy rate was 3.25 per cent. One-in-three (32 per cent) want him to hold the current rate at five per cent to further assess its impact. And a handful of Canadians (11 per cent) want to see rates rise further to bring down inflation.

The harsh economic reality of high inflation has half the respondents (49 per cent) scrambling to feed their families. That number jumps to 77 per cent among those living in households with less than $25,000 in annual income.

Overall, at least a quarter across all income brackets are finding it hard to keep up with food prices, signalling that even higher income households aren’t immune to inflation.

Advertisement 5

Article content

Many are assessing their budgets and finances as a way to cope with the cost pressures. This includes cutting back on discretionary spending (63 per cent), travel (43 per cent), donations (40 per cent), driving (30 per cent) and even deferring their registered retirement savings plan (RRSP) or tax free savings account (TFSA) contributions (28 per cent).

Half of Canadians are delaying big purchases such as a home, car or major appliance, and at least two-thirds across every region in the country are expecting the next 12 months to be a bad time to make these types of purchases.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox._____________________________________________________________

Advertisement 6

Article content

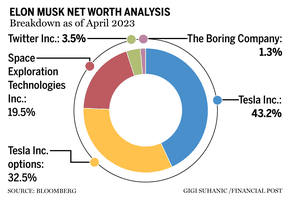

Elon Musk’s fortune slumped US$20.3 billion Thursday after Tesla Inc. warned it may have to keep cutting the prices of its electric vehicles, sending shares tumbling. The drop in net worth to US$234.4 billion further narrows the wealth gap between Musk and Bernard Arnault, the world’s two richest people, according to the Bloomberg Billionaires Index. Musk’s fortune still exceeds that of Arnault, chairman of luxury goods maker LVMH, by about US$33 billion.

— Bloomberg

___________________________________________________

___________________________________________________

Advertisement 7

Article content

_______________________________________________________

____________________________________________________

It’s important to file your tax return on time, whether you’re an individual taxpayer or filing on behalf of your corporation. Failure to do so can lead to late-filing penalties and arrears interest. Tax expert Jamie Golombek examines a recent case involving a late-filed corporate tax return where a business owner lost his bid to overturn late penalties and interest.

Advertisement 8

Article content

The only inflation left is being caused by Bank of Canada

Why higher interest rates could be bad for workers

Federal Reserve interest rate hike forgone conclusion

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation