Breadcrumb Trail Links

News Economy

Rising wages represent a complicating factor because central bankers believe they can be inflationary

Article content

Wages continued to grow in September, extending a trend that will help households cope with higher prices, but could also force the Bank of Canada to hike interest rates again to reverse stubbornly strong inflationary pressure.

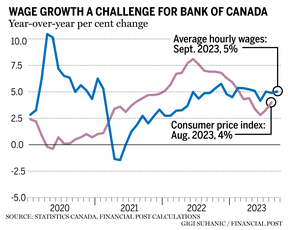

Average hourly wages rose five per cent from September 2022, according to Statistics Canada’s latest monthly tally of the labour market, marking the seventh consecutive month that paycheques increases faster than prices, as measured by Statistics Canada’s consumer price index.

Advertisement 2

Article content

Article content

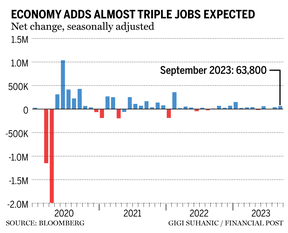

Canadian employers also added some 64,000 positions last month, triple the Bay Street consensus, according to a Bloomberg survey of professional forecasters. The jobless rate was unchanged at 5.5 per cent, which is up from the recent low of around five per cent, but still a historically strong number that suggests the economy continues to have decent momentum.

Despite persistent worries that higher interest rates risk causing a recession, the Bank of Canada insists the bigger worry remains inflation. The consumer price index accelerated to a year-over-year increase of four per cent in August from 3.3 per cent in July and 2.8 per cent in June.

Bank of Canada governor Tiff Macklem is mandated to keep inflation growing at a year-over-year pace of two per cent, a target the central bank has failed to hit since before the pandemic. Macklem has said repeatedly that if he doesn’t crush inflation now, expectations of elevated price increases will become entrenched, making inflation that much more difficult to control later.

The Bank of Canada is next scheduled to make a decision on interest rates later this month.

Article content

Advertisement 3

Article content

Charles St-Arnaud, chief economist at Alberta Central and a former Bank of Canada staffer, said in a note that the central bank “will be concerned by the continued strong wage gains and recent sharp acceleration,” adding that “the likelihood of a rate hike at the October meeting increased further” because hiring remains buoyant and wage pressures continue to rise.

Larger paycheques will be taking some of the sting out of higher prices for essentials such as groceries and gasoline. At the same time, rising wages represent a complicating factor for the Bank of Canada because central bankers believe they can be inflationary. That’s because increased spending power stokes demand, while higher labour bills create an impulse for companies to raise prices to keep their profit margins intact.

Economists aren’t sure that September’s wage result will be enough to push the central bank to hike rates, but they said the number will have the bank’s attention.

“We don’t believe this is enough to tip the scales for the Bank of Canada, but it will keep their tightening bias firmly in place,” said Bank of Montreal chief economist Douglas Porter, in a note on Oct. 6.

Advertisement 4

Article content

Wage growth has been fuelled in part by historic job vacancies and a shortage of workers in the years following the pandemic. The shortfall gave workers more leverage to negotiate bigger salaries to combat inflation that rose to a four-decade high in June 2022.

The Bank of Canada held its benchmark interest rate at five per cent on Sept. 6, but policymakers said they would need to see wage gains slow before they could be confident they were winning the inflation fight.

“Governing Council remains concerned about the persistence of underlying inflationary pressures,” the central bank said in a press release accompanying the rate decision. “In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the two per cent inflation target.”

While latest headlines from the Labour Force Survey were a shock, some economists said the report wasn’t as strong as it appeared.

For example, most of the gains — 48,000 — were in part-time positions and were recorded in the “volatile” education sector, economists said.

Advertisement 5

Article content

“While the headline figures will be grabbing most of the attention, we’d caution on getting too excited,” James Orlando, an economist with Toronto-Dominion Bank, said in his note on the jobs report.

Orlando acknowledged that Statistics Canada’s Oct. 6 jobs report “muddies” the waters for the Bank of Canada. However, he said a lot of more data will be coming before the central bank’s next rate decision on Oct. 25, including a consumer price index report, new retail sales figures and reports on housing.

“The bank will likely need to see significant weakness in these reports to prevent it from pulling the trigger on another hike,” Orlando said.

Tiff Macklem and wages

In a speech in Calgary on Sept. 7, Macklem cited wage growth among inflationary pressures that were “stubbornly persistent.” He said during the speech that he had yet to see clear signs that wage growth was moderating, adding that most measures were hovering around four to five per cent.

The governor has been talking about the centrality of wages since late 2022. In a speech to the Public Policy Forum, Macklem said that growth in pay had “increased and broadened across the economy” and that it and the low unemployment rate were not “sustainable.”

Advertisement 6

Article content

Wage growth is important, said St-Arnaud, because it “shows how sticky inflation is likely to be.” Based on the September jobs report, St-Arnaud said he estimates that wages grew 9.4 per cent on a three-month annualized basis using seasonally adjusted data, “suggesting further acceleration in wage growth in recent months.”

From St-Arnaud’s perspective, continued growth in wages could tilt the balance to another interest rate hike by the central bank. But, the next inflation numbers will be more important, he said in an email. Those data are set for release on Oct. 17 and another increase likely would push the Bank of Canada to hike again, St-Arnaud said.

Andrew Grantham, an economist with CIBC, doesn’t think wage growth will be enough to push the Bank of Canada to hike.

While wage growth was “stronger than policymakers would like to see,” Grantham argued in his note on Oct. 6, that is fallout from earlier shortages in the jobs market as well as increases to wages to account for historically high inflation.

Related Stories

Jobs surge ‘muddies the outlook’ for Bank of Canada

Employers are handing out pay raises. Here’s how much you may get

Bank of Canada warns of inflation ‘feedback loop’

“With the unemployment rate off last year’s lows and expected to rise further as job vacancies continue to fall, wage inflation could ease fairly quickly next year,” Grantham said.

• Email: gmvsuhanic@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Share this article in your social network

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.