Dubai’s residential market continues to expertise a powerful upward development, with values rising by 5.6% in Q1 2023. This marks the ninth consecutive quarter of development, pushed by robust demand for luxurious second houses and town’s emergence as a worldwide luxurious hub.

Villas Outperform the Market

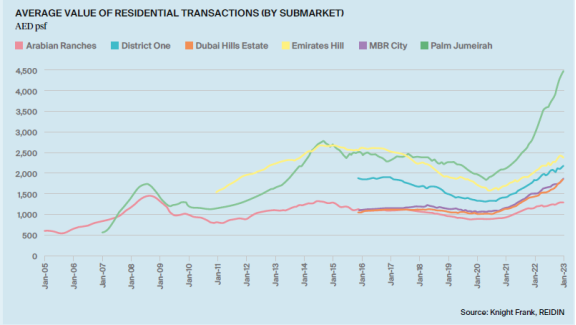

Experiencing a mean development of 5.1% between January and March, reaching AED 1,450 psf. In distinction, house costs elevated by 5.7% to roughly AED 1,230 psf throughout Q1.

Faisal Durrani, Accomplice – Head of Center East Analysis, explains, “Regardless of this robust charge of will increase, costs nonetheless lag the 2014 peak by 15%. Residences have been slower to get better and nonetheless path the final market peak 7-years in the past by 18%. Villas alternatively have equalled their 2014 peak and stay extremely sought, significantly within the higher echelons of the market, with costs now 15% increased than Q1 2022, with much more vital development in prime neighbourhoods.”

Robust Progress in Extra Inexpensive Places:

Dubai Hills Property and Emirates Hills, as an example have skilled sharp will increase in costs as home purchaser demand for bigger houses fuels demand, significantly in additional reasonably priced inland communities. Dubai Hills Property noticed a 23% improve in house costs within the final 12 months, making it one of many strongest gainers within the metropolis.

AVERAGE VALUE OF RESIDENTIAL TRANSACTIONS (BY SUBMARKET)

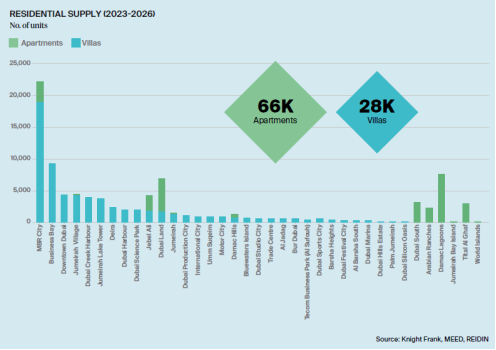

RESIDENTIAL SUPPLY (2023-2026)

Palm Jumeirah Emerges because the Prime Performer

The Palm Jumeirah has been town’s star-performing villa market, with costs rising by 14% throughout Q1 and a 53% development charge over the past 12 months. Knight Frank’s information reveals that villa costs on the long-lasting Palm Jumeirah have elevated by a powerful 126% for the reason that begin of the pandemic.

Andrew Cummings, Accomplice and Head of Prime Residential at Knight Frank says, “The sustained robust demand for luxurious houses from the worldwide elite has considerably contributed to the 44% improve in common villa costs throughout Dubai since January 2020. This degree of development has allowed villa costs to succeed in the final market peak in 2014, demonstrating Dubai’s emergence as a number one international luxurious hub.”

Branded Residential Increase

Branded residential gross sales have seen a pointy rise for the reason that begin of the pandemic, pushed by UHNWI demand. Developments resembling Baccarat Residences in Downtown Dubai have achieved file costs, highlighting the rising recognition of branded residences within the metropolis.

Dubai Market Outlook for 2023

In line with Knight Frank’s report, Dubai’s prime residential market is predicted to expertise the very best development charge for any prime residential market globally, with a projected development of 13.5% in 2023. This development is supported by a transparent demand-supply imbalance and a constructive financial backdrop.

Faisal Durrani, Accomplice – Head of Center East Analysis, concluded: “Three-and-a-half years into the present market cycle, total worth development is moderating because the extraordinary rises registered through the pandemic start to work their manner out of the equation. The underside line nonetheless stays a big mismatch between demand and provide of luxurious houses. This mixed with Dubai’s emergence on the worldwide stage because the go-to second houses market continues to drive costs and certainly this is the reason over the past 12-months, costs have risen by 13%, eclipsing 2022’s 10% development.”