Breadcrumb Path Hyperlinks

Information

Governments want to assist battle inflation by reining in spending, says CIBC

Article content material

Article content material

Good morning,

Commercial 2

Article content material

The Financial institution of Canada might use a bit assist.

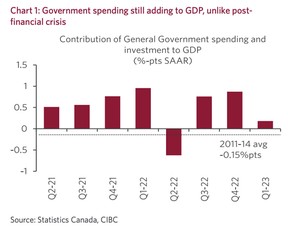

Within the combat in opposition to inflation, central banks, together with Canada’s, have been left to do the “soiled work” of easing demand by elevating rates of interest, says a brand new research by CIBC Economics.

But extra belt tightening by governments would accomplish the identical factor, and have advantages for the financial system that aren’t occurring by letting the Financial institution of Canada do all of the heavy lifting, write CIBC economists Avery Shenfeld and Andrew Grantham.

The Financial institution of Canada raised its benchmark rate of interest once more final week to 4.75 per cent and economists consider one other hike is probably going. Additionally they see charges staying larger for longer, with CIBC pushing its forecast for the primary fee reduce to June of subsequent 12 months.

Commercial 3

Article content material

“If the job of engineering that slowdown is left solely to the Financial institution of Canada, financial coverage must squeeze on development for an extended interval than we beforehand thought,” stated the economists.

Fiscal coverage might do extra to assist “cool off the hearth.”

Although pandemic help packages have now wound down, cheques are nonetheless going out to households. Ottawa’s “grocery rebate” might raise the nation’s gross home product within the second quarter by 0.4 per cent, stated the economists.

“Whereas a lot of the spending was labelled as a manner of serving to households with the prices of residing, the bump up in transfers went above and past inflation and represented stimulus in actual phrases,” they stated.

Authorities has additionally contributed to the overheated labour market, a key concern for the Financial institution of Canada. Good points in public sector employment have surpassed the non-public sector, pushing down the jobless fee, they stated.

Article content material

Commercial 4

Article content material

The economists say federal and provincial governments are lacking a chance to deal with deficits and scale back debt, whereas serving to the Financial institution put a damper on development.

“A method or one other we might want to undergo no less than a stall in development to get inflation again to the two per cent goal,” they wrote.

“So the drag from fiscal restraint can be offset by the power to chart a softer course on rates of interest, by cancelling additional hikes we’d nonetheless face and bringing ahead the timing for some rate of interest reductions.”

As a result of there are downsides to leaving all of the cooling to the Financial institution of Canada.

Rate of interest hikes hit the housing market first, together with house development.

“That’s hardly superb in an setting by which a scarcity of housing is pressuring condo rents and the general price of house possession,” they stated.

Commercial 5

Article content material

Canada’s excessive family debt additionally will increase the chance of a nasty fallout the longer larger charges proceed.

“Mortgage renewals for Canadians in 2024 and 2025 might be a big danger to family monetary stability if the Financial institution of Canada hasn’t sufficiently eased coverage by then,” they stated.

Greater borrowing prices additionally put a damper on companies’ capital spending, when investing to enhance productiveness would decrease inflation by decreasing prices and labour demand.

“It’s not too late to think about a fiscal coverage shift,” stated the economists.

“At a minimal, this isn’t the 12 months for finance ministers who discover a bit more cash of their coffers at mid-year to search for new methods to spend it or dole it out for households.”

_________________________________________________________

Commercial 6

Article content material

Was this text forwarded to you? Join right here to get it delivered to your inbox._____________________________________________________________________

Residence costs aren’t the one factor that determines whether or not you possibly can afford a home. Property taxes fluctuate enormously throughout the nation and should you’re considering of a transfer checking the municipality’s fee is all the time a good suggestion. In response to a research by on-line realtor Zoocasa — which introduced us in the present day’s chart — the 4 lowest charges in Canada are present in British Columbia. Vancouver, Abbotsford, Kelowna and Victoria all have property tax charges below 0.5 per cent.

Examine that to Winnipeg, the place the two.6439 per cent tax fee is the very best within the nation. On the common house price $344,600, householders right here can anticipate to pay $9,111 a 12 months in taxes, greater than double the quantity paid in Edmonton, Quebec and Calgary.

Commercial 7

Article content material

_______________________________________________________

Canadian debtors obtained an disagreeable shock when the Financial institution of Canada hiked its rate of interest by one other quarter share level on June 7, bringing it to 4.75 per cent, up from 0.25 per cent in March final 12 months.

Commercial 8

Article content material

Canada’s industrial banks have been fast to comply with swimsuit, climbing their prime charges to six.95 per cent.

It has been essentially the most fast and aggressive rate of interest climbing cycle in current reminiscence, and it is probably not achieved but.

What does this imply for Canadians with mortgages?

Leah Zlatkin, a mortgage dealer and charges professional, answered your questions on the housing market, variable vs fastened charges and time period lengths on video. Get the solutions

____________________________________________________

As we speak’s Posthaste was written by Pamela Heaven, @pamheaven, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at posthaste@postmedia.com, or hit reply to ship us a notice.

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail should you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Tips for extra info and particulars on the way to regulate your electronic mail settings.

Be a part of the Dialog