[ad_1]

Breadcrumb Trail Links

News Executive Summary Executive

Policymakers are misreading the tea leaves on impact of interest rate hikes so far, says economist

Article content

A Big Six bank economist is calling on central bankers to stop hiking interest rates, labelling the last increase and any others to come as “unnecessary at best” because policymakers are misreading the tea leaves on consumer spending.

Advertisement 2

Article content

Article content

The Bank of Canada surprised a good chunk of Bay Street at its June 7 rate announcement when it increased the benchmark rate that other lending is based on 25 basis points to 4.75 per cent, citing excess demand in the economy as one of its main reasons.

The central bank is scheduled to announce its next rate decision next week on July 12. Naturally, consumers and investors are on high alert, with markets currently pricing in a 55-per-cent chance of another increase.

“History could show that the recent Bank of Canada rate hike (and any subsequent moves) was at best unnecessary, and at worst a mistake,” Andrew Grantham, a CIBC Capital Markets economist, said in a note on July 3.

He said it’s possible previous rate hikes have already started to tame consumer spending a lot more than the Bank of Canada realizes.

Article content

Advertisement 3

Article content

Grantham looked at interest rate-sensitive sectors such as household appliances, furniture and autos — all hit by supply chain snarls during the pandemic — as well as travel services and restaurants, which were shattered by COVID-19 restrictions.

He calculated that consumption in these sectors, adjusted for inflation, increased almost 15 per cent since the first of the Bank of Canada’s eight consecutive rate hikes starting in March 2022. Grantham said the last time the bank hiked rates, in 2017 and 2018, spending in these areas had already started to fall.

But, shift the timeline to before the pandemic, and current spending is still one per cent lower than it was in the fourth quarter of 2019, and it is “even worse on a per-capita basis” based on the population growth the country is experiencing.

Advertisement 4

Article content

Canada added 292,232 more people in the first three months of 2023, or 0.7 per cent, for a total population of 39,858,480 as of April 1, Statistics Canada said on June 28. Immigration was responsible for 98 per cent of the increase.

Looking through the per capita lens, Grantham said consumer spending in interest rate-sensitive sectors is down 10 per cent to 15 per cent from pre-pandemic levels.

“Classifying recent growth in such spending as pent-up demand would be a bit misleading, as households aren’t on average eating out more often or going on an extra vacation to make up,” he said.

The economist said it is possible that supply-chain issues are still hurting spending in some areas and that a shortage of employees is hampering commerce at restaurants and travel. But conditions are improving and “may no longer entirely account for the shortfall in spending in such areas relative to their pre-pandemic trend,” he said.

Advertisement 5

Article content

“In other words, rate hikes may already be working to slow demand, and the true test in terms of growth rates is still to come.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox._____________________________________________________________

Canada’s financial consumer watchdog has released new guidelines aimed at protecting consumers considered at risk of defaulting on a mortgage on their principal residence as rising borrowing costs and high inflation put more pressure on Canadians.

The Financial Consumer Agency of Canada (FCAC) said federally regulated financial institutions, such as banks, are expected to contribute to the protection of consumers by providing tailored support to those at risk.

Advertisement 6

Article content

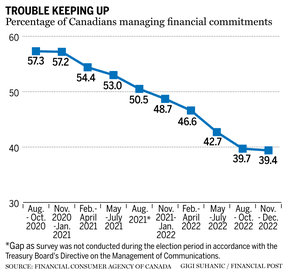

The number of households at risk is a growing problem as those who said they can manage their current financial commitments fell to just under 40 per cent at the end of 2022 from close to 60 per cent in the August to October 2020 period, the FCAC said. — Denise Paglinawan

Read the full story here.

___________________________________________________

___________________________________________________

Advertisement 7

Article content

_______________________________________________________

Bank of Canada expected to raise rates one more time

Recession? Fewer businesses and consumers see it happening

Canada’s economy regains momentum

_______________________________________________________

The government and the financial industry both take for granted that savers know what to do with their retirement accounts once they need to take withdrawals, but so much attention is focused on the need to save for retirement that the rules and strategies for decumulation tend to be overlooked. Jason Heath explains here how start drawing your RRIF in a tax efficient way.

____________________________________________________

Today’s Posthaste was written by Gigi Suhanic, (@gsuhanic), with additional reporting from The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Article content

Share this article in your social network

[ad_2]

Source link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation