[ad_1]

My morning practice WFH reads:

• You’ve Heard About Behavioral Finance. However What About Bodily Finance? Analysis suggests an interesting hyperlink between the bodily world and the way traders worth shares. (Institutional Investor)

• The actual motive Mexico out of the blue dominates international beer exports: In the present day, Mexico ships out greater than twice as a lot beer as some other nation and single-handedly accounts for 30 % of the world’s whole export-beer market, in accordance with Geneva-based commerce statistics supplier Commerce Knowledge Monitor. That places Mexico far above the Netherlands (14%), Belgium (13%) and even Oktoberfest progenitor Germany (9%). (Washington Put up)

• How Curiosity Charges & Inflation Impression Inventory Market Valuations: You’d assume, all else equal, that a lot larger rates of interest and worth ranges would have had a far higher affect on the inventory market. Don’t get me unsuitable — we’ve had a pleasant little bear market. And this sort of snapshot method to market indicators may be deceptive. However for those who have been to inform traders two years in the past that we have been about to enter one of the vital aggressive Fed climbing cycles in historical past mixed with inflation reaching 9%, most would have assumed issues can be lots worse. (A Wealth of Widespread Sense)

• Don’t Trouble Investing in China Except You’re Chinese language: Solely a neighborhood can correctly circumvent the nation’s notorious firewall. Even asset managers in Hong Kong not have a transparent image of the mainland. (Bloomberg)

• Why was Labor Productiveness Progress So Excessive in the course of the COVID-19 Pandemic? The Position of Labor Composition: Within the first few weeks of the COVID-19 recession, round 20 million individuals misplaced their jobs, with half of these losses occurring within the final two weeks of March 2020. On the tail of those unprecedented job losses, labor productiveness grew at an annualized fee of 11.2 % in 2020q2 and the common hourly wage elevated sharply. (Bureau of Labor Statistics)

• How YIMBYs Gained Montana: A wave of laws designed to reform native zoning guidelines and increase housing is sweeping this GOP-led state, because of an uncommon left-right coalition of supporters. (CityLab)

• The State of International Gender Fairness: Regardless of efforts to advance gender fairness, ladies nonetheless lag behind males in house possession, labor power participation, board illustration and lots of extra areas. Right here’s why. (J.P. Morgan Analysis)

• The Counteroffensive: The way forward for the democratic world might be decided by whether or not the Ukrainian navy can break a stalemate with Russia and drive the nation backwards—even perhaps out of Crimea for good. (The Atlantic)

• What Actual Meteorologists Want You Knew About Your Climate App: The belief you’re seeing is one attainable consequence of a mannequin that will get run each six hours. However climate is extra complicated. It’s a broader envelope of outcomes, which you’re in all probability not seeing in your app. (Slate)

• 5 Minutes That Will Make You Love Herbie Hancock We requested musicians and consultants, together with Thundercat, Patrice Rushen and Nicole Sweeney, which Hancock tune they’d play for a good friend. (NYT)

Be sure you take a look at our Masters in Enterprise interview this weekend with Julian Salisbury, Chief Funding Officer of Goldman Sachs Asset & Wealth Administration, with $737 billion in belongings beneath administration. He’s a member of the Administration Committee and Co-Chair of the Asset Administration Funding Committees, (non-public fairness, infrastructure, progress fairness, credit score, and actual property).

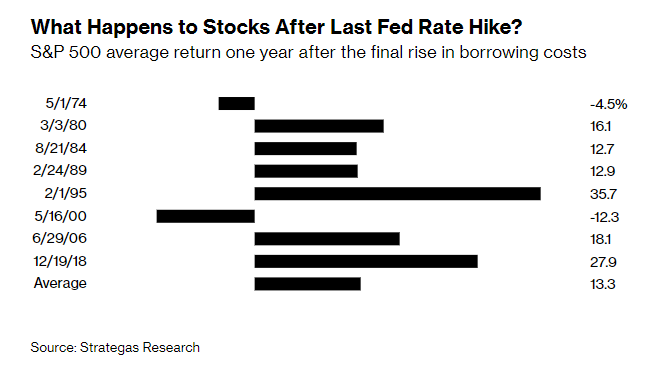

A Historic Have a look at S&P 500 $SPX returns after the Final Federal Reserve Charge Hike Supply: Strategas by way of @Barchart

Supply: Strategas by way of @Barchart

Join our reads-only mailing listing right here.

[ad_2]

Source link

Leave a Reply